However, they may ask you for an indemnity bond first. In the case of a lost, damaged or stolen cashier’s check, you can ask your bank to reissue the check.

Taking extra care when handling and transporting a cashier’s check can help save you from a headache. Losing a cashier’s check isn’t the end of the world, but it can present a significant speedbump for your transaction. But exactly how long do cashier’s checks take to clear? Funds for cashier’s checks deposited in-person can be available as soon as the next business day - though this varies by circumstance and financial institution. How long does a cashier’s check take to clear?Ĭashier’s checks tend to process faster than ordinary checks. For things like down payments on mortgages, vehicles or capital equipment, cashier’s checks are generally preferred - and sometimes required. The added security features of a cashier’s check make it well-suited for high-value transactions. This provides assurance to the recipient that the funds are ready and waiting for them. Plus, it has the defining feature of being backed by bank funds instead of personal funds. Each cashier’s check is signed by one or more official bank employees and may include extra security features like additional watermarking. official checks, come with added layers of security that can help make payments safer and more reliable than ordinary personal checks. So, what is a cashier’s check? Cashier’s checks, a.k.a. For this reason, some important transactions might call for cashier’s checks instead of personal checks. This makes cashier’s checks unlikely to bounce. Unlike ordinary checks, a cashier’s check is backed by the funds of the financial institution issuing it, rather than the payee. Products not available in all states.A bounced check is a real headache for both the payer and the payee. JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. Insurance products are made available through Chase Insurance Agency, Inc. Morgan Securities LLC (JPMS), a registered broker-dealer and investment adviser, member FINRA and SIPC. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Past performance is not a guarantee of future results. Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. "Chase Private Client" is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. is a wholly-owned subsidiary of JPMorgan Chase & Co. “Chase,” “JPMorgan,” “JPMorgan Chase,” the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A. Contact a bank representative with any questions you may have. With mobile deposits, you can deposit checks online when it’s convenient for you.

#CHASE GET CHECKBOOK HOW TO#

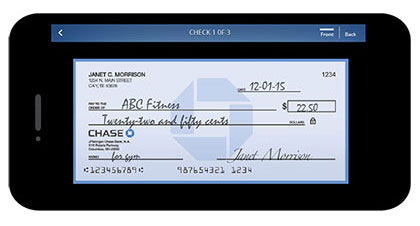

Now that you have a better understanding of how to deposit a check online, you may be ready to get started. The time it takes to complete an online deposit can vary by bank. How long does an online check deposit take? Examples of checks that may be accepted include: Not all checks are accepted through mobile deposit. Be sure to reach out to your bank for specific information regarding deposit limits. You might even have weekly or also monthly deposit limits. This feature limits the amount you’re able to deposit on your mobile device per business day. These limits may differ from person to person depending on factors like:ĭepending on your bank, you may also have a daily deposit limit. With mobile deposits, there may be limits associated with how much you can deposit at once. Not every bank supports every phone or operating system, so check with your bank to confirm that your phone is supported. Choose "Deposit," then tap "Yes" to confirm.Tap "Front" and take a photo of the front of the check.Tap "Deposit checks" and choose the account where you want your deposit to go.Sign into your selected banking mobile app.Some steps to deposit an online check may include: Chase customers can use the Chase QuickDeposit℠ feature on the Chase Mobile® app to deposit funds. To start, use your bank’s mobile app to make a mobile deposit. The option to deposit your check through mobile deposit may help save you some time - and a trip to the bank. To be eligible for a mobile deposit, you typically must have a checking or savings account with the associated bank. Customers can deposit checks online using a mobile device. If you’re wondering how to deposit a check online, you’re in luck.

0 kommentar(er)

0 kommentar(er)